If the cash price was 7000 plus 1225 of VAT which was reclaimed as input tax the double entry is. So what is the double entry for.

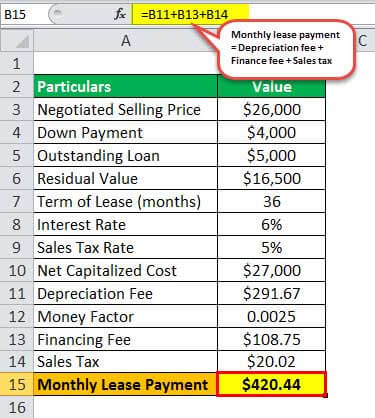

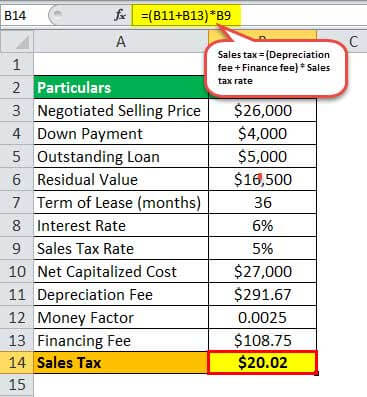

Lease Payment Formula Example Calculate Monthly Lease Payment

To update hire purchase of motor vehicle.

. The monthly payment over 3 years is. You may claim the GST incurred on the purchase of a motor vehicle if it is not disallowed under the GST law. The first double entry records the disposal of the asset with a corresponding credit to the bank for the outstanding amount owing on the hire purchase.

You should consult your accountant if you have doubt in. A and company ABC have made the hire purchase agreement of the car. There are four methods of accounting for hire purchase.

When received part payment from buyer. Ad Avoid The Stress Of Doing It Yourself. The payoff was 1315538 and we sold the vehicle to a dealer for 10000 and then wrote a check from our personal account for 315538 to make up for the difference on the loan.

The agreement that includes the assumption of goods and at the same time giving a. I supply cars to car dealers. The double entry will be.

Should do the trick. The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense. Motor Vehicle ABC XXXX Fixed Asset Dr.

Journal Entry for Sale of a Vehicle with a loan. First we need to calculate the loss on disposal of the old motor vehicle. What are the correct journal entries for the sale of a vehicle with a loan.

Fixed asset trade in double entry bookkeeping. When I am purchased the car Debit Car 70000 Credit. A fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a trade in allowance on an old vehicle.

The interest paid was 4890. Amount RM199000 from your bank account. CR Disposal of Motor Vehicle Account.

The second double entry records the settlement of the hire purchase creditor with a corresponding debit to the bank for the amount owing. Enter the following items and accounts. Since it was exchanged for fair value of 5000 and had a net book value of 6000 17000 11000 the loss.

You need to account for GST when you sell the motor vehicle even if you are not entitled to claim input tax for the purchase. When I pay the down payment Debit Account payable 20000 Credit Bank 20000. Double entry for disposal of motor vehicle under hire purchase.

Amount Owing to Director Current Liabity Cr. Create a Purchase Payment with the same supplier. When transactions or event happen we record them.

Cash 4200000 this is the amount spent for the new van We would also make entries to start taking. CR Fixed Asset Account - Motor Vehicle. Enter Your Zip Code Get Started.

Dr Interest 145460 Dr Loan 5013113 Dr Acc Dep 12699. Recording the Payment for Monthly Instalment. Accumulated Depreciation 1000000 this removes the depreciation taken on the old van Credit.

Under cash price method we are deal hire purchase transactions just like normal transactions. Road Tax Insurance Expenses Cr. Claiming Input Tax for Purchase.

DR Disposal Of Motor Vehicle Account. Amount RM7500000 from your bank account. Deposit Paid Current Assets Cr.

To offset the Fixed Asset Account. Hire Purchase ABC XXXX Current Liability 3 To Updated Hire Purchase Interest in Suspense. Hire purchase interest-in-suspense RM4000.

Apply all credits to the original bill. If the total payments are only 8225 the HP company is not charging any interest. New Van 5000000.

Journal Entries in the books of Purchaser. Old Van 1500000 this removes the old van Debit. Cr Motor Vehicles 5302613 Cr VAT 10100 Cr Gain on Sale or Depn Recovered 115860.

Create a Money Out transaction. Journal entry for disposal of motor vehicle under hire purchase Chapter 2 accounts of implementation of implementation of implementation of implementation of 1967 amendment and Islamic perspective 211 definition of purchase section 21 Law on the purchase of rental 1967. Hi Can anyone guide me what is the accounting double entry for selling of Fixed Asset - A Car.

HP Interest in Suspense ABC XXXX Negative Current Liability Cr. The double entry of this bill debits the Hire Purchase Current account and credit Accounts Payable or Bank account if Write Cheque is used instead of the Enter Bill transaction. Charging Output Tax for Sale.

Purchase and Sale of Motor Vehicles. DR BS Motor Vehicles 7000. CR BS HP Liabilities 7000.

When the hire purchase has been approved transfer from account payable to hire purchase creditor. Code the Revenue 1046887 to Motor Vehicles and process the following journal. Use the purchase invoice transaction to record the bill received from the car company for the vehicle purchased.

A For buying assets on hire purchase. The accounting entries would be as follows.

Lease Payment Formula Example Calculate Monthly Lease Payment

What Are The Journal Entries For The Cash Sale Of A Vehicle Quora

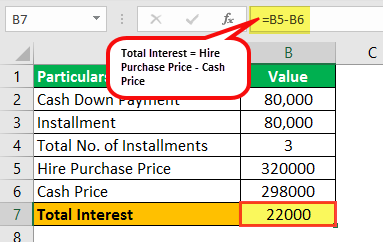

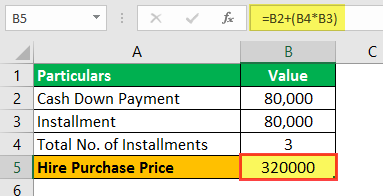

Hire Purchase Meaning Agreement Calculation What Is It

Insurance Journal Entry For Different Types Of Insurance

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Hire Purchase Meaning Agreement Calculation What Is It

Lease Payment Formula Example Calculate Monthly Lease Payment

What Are The Journal Entries For The Cash Sale Of A Vehicle Quora

Insurance Journal Entry For Different Types Of Insurance

Hire Purchase Meaning Agreement Calculation What Is It

Hire Purchase Meaning Agreement Calculation What Is It

/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

Pros And Cons Of Leasing Or Buying A Car

Sample Corporate Resolution To Sell Corporate Shares Mycorporation